Tuesday, March 31, 2009

Paul Krugman's Dismay

The plan to me is a surrender to the captains of Wall Street who had brought us this catastrophe. Geithner's plan provides a central role to the very same people who should really be cleared out of Wall Street. Second, his largesse to the fund management industry by lending money at 6 to 1 leverage to a selected few to buy toxic assets with NO RECOURSE should these investments tank is outrageous.

I think taxpayers are still giving Obama the benefit of the doubt that the plan will work and that the government would even make money from this Public-Private Investment scheme. If the scheme fails, I dread to think how the voters would do.

Friday, March 20, 2009

It's a Fraternity

WASHINGTON — Obama administration special envoy Richard Holbooke was on the American International Group Inc. board of directors in early 2008 when the insurance company locked in the bonuses now stoking national outrage. Holbrooke, a veteran diplomat who is now the administration's point man on Pakistan and Afghanistan, served on the board between 2001 and mid-2008.

We should Shut Up?

Among his pearls of wisdom were this: "First, as I've said in the past, this isn't about fairness. There's nothing remotely fair about using taxpayer money to rescue a free-market financial system from the mistakes of the financiers. But the reality is that we can punish the bankers or we can save the banking system, but we can't do both at the same time."

Wrong. The financial industry is full of talented, yes, even ethical professionals, who had nothing to do with mismanaging their firms by their seniors. Yes, you can promote them to replace those who were responsible and in the process save the banking system. Mr Pearlstein's bio does not indicate he has ever worked for a financial firm, let alone a major one. He was out of his depth on this one.

Pearlstein: "Homeowners who have paid their bills and have been careful not to take on too much credit are now being asked to provide relief to homeowners who have not. Unfortunately, the price of righteous indignation is a wave of foreclosures, a further decline in home values...Given the financial and economic hits they have already taken, that's a price that most "innocent" homeowners and taxpayers would probably prefer not to pay. "

Really? Prices are going to go down whether government wants to support home prices or not. Pearlstein failed to understand government can only set "nominal" prices, market sets "real" prices.

Let's say government managed to fix a house at x, which is 40% lower than you paid for to avoid banks calling for further margins. At that price you can still manage to keep your house by digging into your diminishing savings.

But the "real" price will be set by the economy which would further decline to compensate for the articifically high prices propped by the government. Economic decline would mean you losing your job and not being to find work, perhaps any work. Everyone else is scrambling to become just a janitor.

One recent report had 700 applicants for one janitor job at a high school, yes, in the Mid West.

No job, no mortgage servicing even at lower interest rates,, even if the banks don't want more margin deposits. That's what economists mean when they say market sets the "real" prices versus "nominal" prices.

Pearlstein said the issue was never about "fairnes".

A society disintegrates if sufficient number of citizens feel unfairly treated by those whom they had elected as leaders, whether they are in the White House, in local communities, in churches or in banks.

Economic polices are rarely divorced from the issue of fairness even if efficiency is a primary concern. To dismiss the relevance of fairness is the work of a simple minded journalist, or perhaps a not-so-simple minded hack lobbyist for the financial sector.

Pearlstin had this punch line:

"A final point on outrage: We need to save some of it for ourselves. While it was Wall Street that got rich by peddling new ways for Americans to live beyond their means, the decision to do so was ours. It was we who ran up the credit card bills, we who drew down the equity in our homes and we who refused to tax ourselves for the government services we demanded. Wall Street bankers may have been the pushers, but it was we Americans who became addicted to the easy credit."

Was he not defending the "system" earlier in his piece? The system provided false incentives dished out by the same leaders who paid themselves billions who ought to have known better.

Is it fair to blame Joe the Electrician not to understand that "mortgage securitization" had intrinsic risks? Can we blame him for not knowing bond rating agencies also went along and gave misleading, if not criminal, passing grades on lousy companies? Should he tell his banker to take a hike if the banker is willling to give him a loan based on no money down and a baloon payment towards the end while telling him "It's ok, Joe. Don't worry about it"?

The ordinary Joe Blow's accept that there are those in society who enjoy high prestige and high financial rewards because they are supposed to be smarter. The JB's don't complain. They follow.

Mr. Pearlstein is now blaming the JB's for following wrong signals produced by the system he wants to preserve.

Many polls taken indicate journalists "enjoy" a prestige slightly higher than prostitutes. Unfortunately, Mr. Pearlstein is validating those polls.

Curiouser and curiouser! Is someone lying?

"In an interview with CNN's Ali Velshi Thursday, Treasury Secretary Timothy Geithner confirmed that his department had pushed Sen. Chris Dodd to add a loophole in the federal stimulus bill allowing bailout recipients to receive bonuses. Dodd had told the network Wednesday that he had been the one to insert the loophole, but at the request of the Treasury.

The Treasury Department was concerned that legislation that would restrict contractual bonuses would not hold up to legal challenges, Geithner said in an interview with CNN's Ali Velshi. "Thursday, March 19, 2009

Whose resignation is imminent, Bernanke or Geithner's?

"I was stunned when I learned how bad this was on Tuesday [March 10]," Geithner [Secretary of Treasury] said. "I shouldn't have been in that position, but it's my responsibility and I accept that."

Meantime, President Obama denied anyone at the White House flanked by Geithner and Summers was responsible and he praised Geithner for being the hardest working "guy" he knew. "Ultimately, it is my responsibility" said the President.

This is a B movie we have seen too many times. It often ends in predictable fashion: Geithner or Bernanke would tender his resignation and the president would "regretfully" accept.

The Obama economics teams is unravelling and it is painful to watch as more bad economic news is surely to follow. Yet the US does not seem to have a first rate team to cope with it.

The latest Rouhini comment in Forbes magazine is sobering. Read it at:

http://www.forbes.com/2009/03/18/american-economy-housing-bubble-madoff-opinions-columnists-ponzi.html?partner=daily_newsletter

Panic button?

Tuesday, March 17, 2009

Chimerica?

Don't laugh too soon. The history of economics suggests that alternatives could always be found or invented -- given time.

No country, especially China being the single largest creditor country to the US, with unmistakable geopolitical ambitions would want to remain stuck in this Chimerican dilemma. The greenback may remain strong today since it is the only reserve currency, but will it remain so forever?

I would bet China will now accelerate its financial reforms to enable its own currency, the RMB, to become a credible reserve currency in the not too distant future. 10 years max? The downfall of Wall Street should mark the beginning of the end of the supremacy of the US Dollar.

What Did They expect?

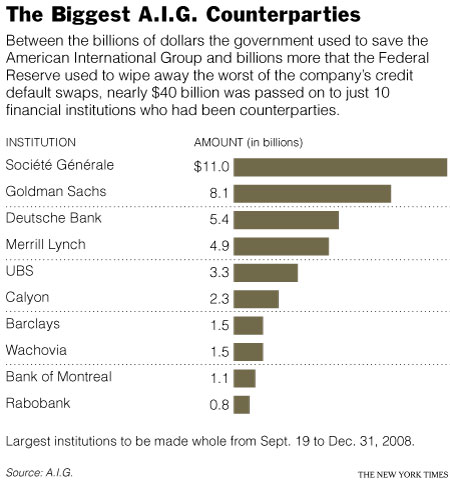

Goodness me. What did they expect? AIG was going under precisely it had owed a lot of people a lot of money in writing unhedged insurance derivatives. If AIG were not to be allowed to pay off its counterparties, then the former Treasury Secretary Hank Paulson should have had laid down very concrete rules as to how money could or could not be used.

But was it ever feasible? I am not sure. Money is fungible. Pouring new soup into a bowl of old soup, it becomes just soup. you cannot separate the two.

The outrage suggests this: the original rescue package under Paulson was totally without supervision or constraints, by design or negligence. The new economics team has no idea how Wall Street firms are run. Very comforting to be reminded of this on a daily basis. Have a good day.

Friday, March 13, 2009

The Changing of "Feng Sui" Guards

Remember Gordon Chang's book "The Coming Collapse of China"? Its thesis was Chinese banks were all technically bankrupt. Only the printing of money to inflate out of China's negative equity balance sheets would get the banks back into solvency at the cost of hyperinflation. Substitute China with US.

Tuesday, March 10, 2009

What if Obama flunks Economic Crisis 101?

Obama is the Leader now. If he accepts bad advice from Larry Summers (PhD Harvard) Tim Geithner (Treasury Secretary) and from Ben Benanke (PhD MIT), he "owns" the results. Advice so far is worse than bad. It's awful. Enough has been said on why it is so.

The stockmarket continues to mark down asset values as Obama bravely tells the world his dithering plan would work. It is a general economic rule ignored by nearly every political leader that governments can set Nominal prices (exchange rate is the typical example), markets set the Real prices. During the Asian financial crisis, Hong Kong government stubbornly resisted changing the fixed rate of 7.8 against a US$ despite its gross overvaluation. The market forced the real rate down by giving 6 years of deflation in the economy causing huge economic losses in real terms: contraction, stagnation and rising unemployment. The length of contraction was determined by how long did it take to have Hong Kong prices of goods and services decline on a relative basis against US prices of goods and services so that after adjusting for these changes, the real rate of exchange got closer to 7.8, the nominal rate.

So when the market is convinced right now the Obama Administration is not brave enough to force banking managements to fess up the worthlessness of their assets, the stockmarket is doing that for him.

Citibank, JP Morgan, GM, AIG are priced as bankrupt companies. The values quoted are what accountants call "goodwill". Their brands are worth something. That something today assumes their balance sheets are all punk.

Paul Krugman:

March 9, 2009

OP-ED COLUMNIST

Behind the Curve

By PAUL KRUGMAN

President Obama’s plan to stimulate the economy was “massive,” “giant,” “enormous.” So the American people were told, especially by TV news, during the run-up to the stimulus vote. Watching the news, you might have thought that the only question was whether the plan was too big, too ambitious.

Yet many economists, myself included, actually argued that the plan was too small and too cautious. The latest data confirm those worries — and suggest that the Obama administration’s economic policies are already falling behind the curve.

To see how bad the numbers are, consider this: The administration’s budget proposals, released less than two weeks ago, assumed an average unemployment rate of 8.1 percent for the whole of this year. In reality, unemployment hit that level in February — and it’s rising fast.

Employment has already fallen more in this recession than in the 1981-82 slump, considered the worst since the Great Depression. As a result, Mr. Obama’s promise that his plan will create or save 3.5 million jobs by the end of 2010 looks underwhelming, to say the least. It’s a credible promise — his economists used solidly mainstream estimates of the impacts of tax and spending policies. But 3.5 million jobs almost two years from now isn’t enough in the face of an economy that has already lost 4.4 million jobs, and is losing 600,000 more each month.

There are now three big questions about economic policy. First, does the administration realize that it isn’t doing enough? Second, is it prepared to do more? Third, will Congress go along with stronger policies?

On the first two questions, I found Mr. Obama’s latest interview with The Times anything but reassuring.

“Our belief and expectation is that we will get all the pillars in place for recovery this year,” the president declared — a belief and expectation that isn’t backed by any data or model I’m aware of. To be sure, leaders are supposed to sound calm and in control. But in the face of the dismal data, this remark sounded out of touch.

And there was no hint in the interview of readiness to do more.

A real fix for the troubles of the banking system might help make up for the inadequate size of the stimulus plan, so it was good to hear that Mr. Obama spends at least an hour each day with his economic advisors, “talking through how we are approaching the financial markets.” But he went on to dismiss calls for decisive action as coming from “blogs” (actually, they’re coming from many other places, including at least one president of a Federal Reserve bank), and suggested that critics want to “nationalize all the banks” (something nobody is proposing).

As I read it, this dismissal — together with the continuing failure to announce any broad plans for bank restructuring — means that the White House has decided to muddle through on the financial front, relying on economic recovery to rescue the banks rather than the other way around. And with the stimulus plan too small to deliver an economic recovery ... well, you get the picture.

Sooner or later the administration will realize that more must be done. But when it comes back for more money, will Congress go along?

Republicans are now firmly committed to the view that we should do nothing to respond to the economic crisis, except cut taxes — which they always want to do regardless of circumstances. If Mr. Obama comes back for a second round of stimulus, they’ll respond not by being helpful, but by claiming that his policies have failed.

The broader public, by contrast, favors strong action. According to a recent Newsweek poll, a majority of voters supports the stimulus, and, more surprisingly, a plurality believes that additional spending will be necessary. But will that support still be there, say, six months from now?

Also, an overwhelming majority believes that the government is spending too much to help large financial institutions. This suggests that the administration’s money-for-nothing financial policy will eventually deplete its political capital.

So here’s the picture that scares me: It’s September 2009, the unemployment rate has passed 9 percent, and despite the early round of stimulus spending it’s still headed up. Mr. Obama finally concedes that a bigger stimulus is needed.

But he can’t get his new plan through Congress because approval for his economic policies has plummeted, partly because his policies are seen to have failed, partly because job-creation policies are conflated in the public mind with deeply unpopular bank bailouts. And as a result, the recession rages on, unchecked.

O.K., that’s a warning, not a prediction. But economic policy is falling behind the curve, and there’s a real, growing danger that it will never catch up.

Copyright 2009 The New York Times Company

Privacy Policy Search Corrections RSS First Look Help Contact Us Work for Us Site Map

Friday, March 06, 2009

Can We Get Back Those Wall Street Bonuses?

What about their Boards? Those who sat on audit and compensation committees who ok'd those bogus accounts and obscene bonuses?

What about shareholders in fact? Institutional investors are the principal shareholders on behalf of millions of small savers through mutual and pension funds.

What about university endowment funds that, too, are big shareholders. How come over those years they never protested?

Better late than never.

There is apparently a way to get some of those bonuses back, if not in whole, certainly in part. In any case, we, savers and taxpayers, are owed a moral judgement.

I want to pass onto you a marvelous article about this crooked lawyer who knew how to get some back: -

http://www.thedailybeast.com/blogs-and-stories/2009-03-06/how-to-shake-down-the-banks/

Given the tone deafness of those in DC managing this crisis, it is certain that nothing will come of it.

A Sinking Feeling

If we are charitable we accept their word at face value: personal reasons.

However, there are at least two perfectly logical ones: one is they don't want to be associated with what is clearly a failed economic "policy", the works of Summers/Geithner/Bernanke to restructure Wall Street. Paul Krugman's column in today's New York Times: The Big Dither says it all.

We don't have the luxury of dithering. The world economy is one step out of the cliff, the financial markets are tanking daily.

It does not require advanced economic training to understand what's happening. Banks are insolvent. Their leaders who bankrupted the banks don't want to be thrown out of work by refusing to come clean to the public with the actual state of their respective balance sheets.

US government is amazingly unwilling to clean them out and take over the banks to instill credibility and liquidity.

No one trusts each other out there. It takes a failed banker to recognize another. So, no one is lending to each other. Everyone on Wall Street privately knows the 'other' is a failed bank. Yet publicly every banker puts up a brave front.

Let's face the obvious. The new economic Obama team is not up to the job. Wall Street bankers are still playing them for fools. Yet Obama seems blissfully oblivious to this game.

Until and unless Summers/Bernanke/Geithner make an about turn or are fired for their incompetence, I say US market is still a screaming short. The Dow Jones index is headed for 5000.

Mr. Geithner, are you awake?

The market has done that for him. Today, Citigroup share has gone below $1 in intraday trading. The investing public is telling Mr. Geithner that the bank is bust.

Wednesday, March 04, 2009

A trillion here, a trillion there....

"Senate Republican leader Mitch McConnell said that Americans have become desensitized to just how much money that is being spent.

"To put a trillion dollars in context, if you spend a million dollars every day since Jesus was born, you still wouldn't have spent a trillion," McConnell said.

CNN checked McConnell's numbers with noted Temple University math professor and author John Allen Paulos.

"A million dollars a day for 2,000 years is only three-quarters of a trillion dollars...

a trillion seconds is 32,000 years," Paulos said.

"The [Environmental Protection Agency's], for example, annual budget is about $7.5 billion. So, a trillion dollars would fund the EPA in present dollars for 130 years -- more than a century. Or the National Science Foundation or National Cancer Institute have budgets of $5 [billion] or $6 billion. You could fund those for almost 200 years," he said.

I think these down to earth examples provide an astounding perspective of how much taxpayers are spending to bail out incompetent senior executives running Wall Street and Detroit.

Not Just Wall Street

Sunday, March 01, 2009

Day 1: Why This Blog

I am starting my blog today. Life cannot go on as before because this global financial and economic crisis is affecting me and the lives of many others. But that's not the real reason I want to start sharing my thoughts, nay, my anger about what has happened and what continues to happen in Washington and on Wall Street.

Yes I know mismanagement by public officials is global. Same with greed and corruption at high places, public or private. However, what is going on in the US is on a scale far bigger than anywhere else at this point.

Anger is a two edged sword. It can cause irrationalilty but it can also move otherwise lethargic people, like myself, into doing "something", something constructive.

I am not consumed by anger. I do wish to point out some of the salient aspects of what is being done by Obama's economics team that may or may not be working to resolve the crisis.

My interest is not soley of a technical nature such as "Is a convertible preference share swap into common stock into Citigroup the most efficient way to unblock the freeze in the credit market." There are many others far better qualified than I to analyse such issues.

Rather, I would take one or two steps more and look at the "fairness" of the deal. In the arcane language of economic theory, this approach was known as "welfare economics."

I will try to avoid jargons. They ofuscate more often than illuminate.

There is much confusion and unhappiness all around regarding what is being done to bailout overpaid financial "geniuses" who got us into where we are.

Perhaps some straightforward thinking is in order devoid of patronizing and obfuscating technical terms preferred by those who run our system.

This blog hopes to contribute to that effort so that we, those who pay taxes and mortgages on time, may know what to do to make the system a little better in the future.

Towards this end all of us need to be a little more vigilant of possible misdeeds committed by those we usually consider as our leaders or pillars of society: bank presidents, Treasury Secretaries, Central Bankers and elected officials.

Perhaps our vigilance will result in advance warnings before the next perfect storm could ever gather sufficient force to engulf us all as this one is doing right now.